do dealerships ask for proof of income

Subprime lenders need proof of income in the form of computer-generated check stubs or proof of income with tax returns andor bank statements if you have anything other than W-2 income. This is what you need to bring to show proof of income when taking out a bad credit auto loan.

When talking with a local car dealer you should ask about its income requirements before applying for a loan.

. To prevent infection and to slow transmission of COVID-19 do the following. Lenders typically ask for your most recent monthly check stubs though the specific number required varies by lender. The documents recognized as proof of income and creditworthiness varies.

The first step a lender might take is asking for your pay stubs. The dealership doesnt care about your tax returns the bank is requesting them. But if you dont provide proof of income or employment verification the lender may want to see that you have a good credit history or view a bank statement or other records to show that you have the money needed to repay your debt.

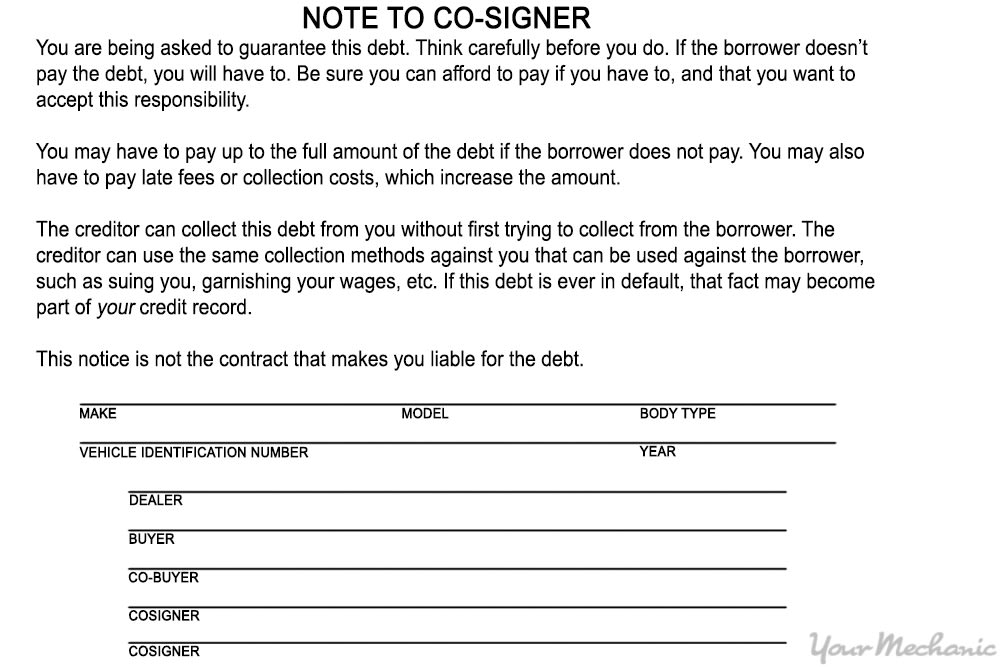

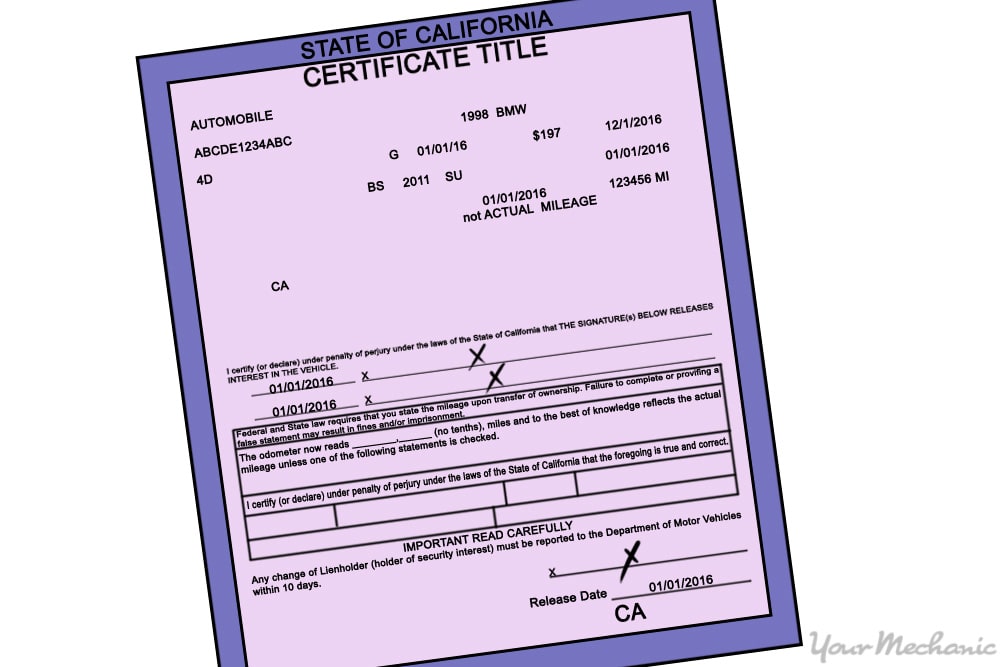

The dealership will have to contact the Department of Motor Vehicles for proof that you really do own the car. As such you need to present your pay stubs. I dont think the lender wanted the income I think it was the dealership covering there bases before I filed.

It doesnt mean youre approved but it means a lender is interested enough to keep the process going rather than simply declining you. Therefore youll need to make sure you have some recent stubs to provide to the lender. But if you have a non-traditional source of income or the bank has difficulty getting information from your employer the.

If you have bad credit the lender will ask for proof of income and will have a minimum income requirement you must meet generally 1500 to 2000 a month pre-tax. If you dont want to give the bank what they want then take the car back. If you are shopping around for a new car you may find it helpful to know when and why auto lenders verify income and employment.

Income In order to buy or lease a car there needs to be some evidence that you can afford to make the monthly payments. Theyll verify whether the pay stubs are real or fake before you proceed. Although the minimum income requirement varies by lender they typically want to see you make anywhere from 1500 to 2000 a month before taxes.

The second way you can prove your income is by providing bank statements and tax returns. Approved for credit is step 1. Luckily showing proof of income as a self-employed individual is a lot easier than most realize.

For most W-2 employees banks verify income for auto loans quickly and smoothly. I was however once asked for proof of income while paying for a car in full with 16K cash. Your lender may ask you for your most recent bank statement with your application or may obtain verification of your income through other sources.

Proof of income is required for credit checks for contracts with long-term installments. This is to make sure youre able to make the monthly payments. Verifying your income is another process entirely.

May 7 2021 by Kevin Haney. If your credit score isnt the best they require hard proof that youre able to take on a bad credit car loan. If you have excellent credit you may not need to show proof of income but there are sometimes exceptions to that.

If you have good credit lenders arent going to ask for proof of income most of the time. You can apply for financing elsewhere and use the dealer as a last resort for financing if you prefer. In most cases they need to ask for your proof of income to ensure that you have the capability to handle your proposed car loan.

No game they just want your pay stubs to reflect your stated income and they want proof that you live where you say you live so youre not falsely stating your living arrangement. Your bank credit union car dealer or finance company may contact your employer and or ask for proof of income documentation for marginal applications if they cannot do so electronically via an. I have financed probably 12 cars in my time And the only time I have ever been asked for income was the first and last time I allowed a dealership to do the financing.

Wash your hands regularly with soap and water or clean them with an alcohol-based hand rub. You will be required to bring standard documentation to the lender to help asses your personal and financial situation to get a car loan approval. Read on if you want to know more about the entire income verification process.

Keeping your tax returns profit and loss statements and bank statements all in the same place will make proving your income easier down the road. The bank isnt satisfied with your proof of income. Keep the loan amount small relative to your incomeexisting debt.

But when your credit isnt great subprime lenders use you your income to help determine what you qualify for. A dealership asking for pay stubs is a standard part of the auto loan application process. The most important thing to keep in mind when proving your income is to keep constant documentation.

Proof of income can come in the form of a bank statement or paycheck stub. However if a dealer is asking for proof of income you may have an issue with your debt-to-income ratio which is the amount of debts you pay each month in comparison to the amount of money you claim to make. Verifying Income And Employment For Auto Loan.

If you get handwritten checks or your check stubs dont include year-to-date income information you typically cant use them. Plan Ahead You can apply for financing at your local bank before you shop for a new car or you can wait until you select a. This can vary but 20 of the cars purchasing price is a good benchmark.

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

Do Fake Pay Stubs Work On Cars Quora

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

Can A Car Dealership Ask For Paystubs Days After You Signed All Paperwork And Was Given The Car Quora

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

I Own A Car Dealership Ask Me Anything Myfico Forums 3574903

What Can Be Used As Proof Of Income Auto Credit Express

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

0 Response to "do dealerships ask for proof of income"

Post a Comment